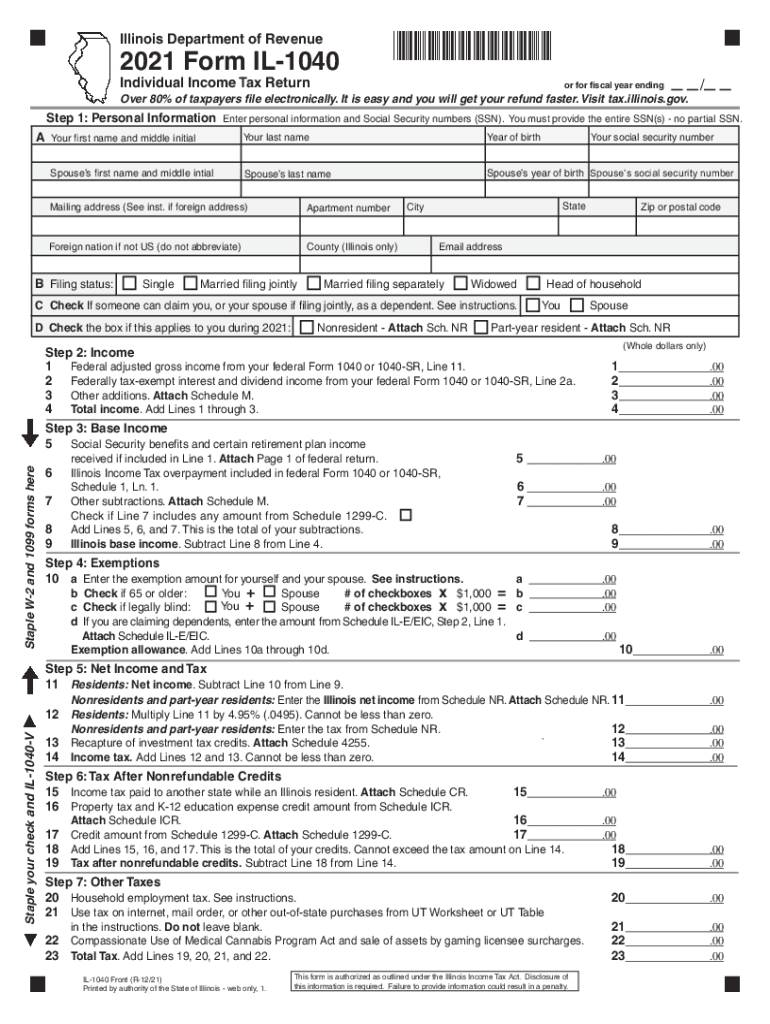

Illinois 1040 Form 2025

BlogIllinois 1040 Form 2025 - Il 1040x Fill out & sign online DocHub, Deadline just days away to fill out form for illinois income and property tax rebates. The tax filing deadline is monday, april 15, 2025. Illinois Employee Tax Withholding Form 2023, Deadline just days away to fill out form for illinois income and property tax rebates. You must file the form 8843.

Il 1040x Fill out & sign online DocHub, Deadline just days away to fill out form for illinois income and property tax rebates. The tax filing deadline is monday, april 15, 2025.

The extended due date for filing your return is october 15, 2025.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Step 6 tax after nonrefundable credits. 2) income, base income, net income, and tax;

:max_bytes(150000):strip_icc()/IRSForm1040-SR-cabde4390e1b4590b59cf978edb7675e.png)

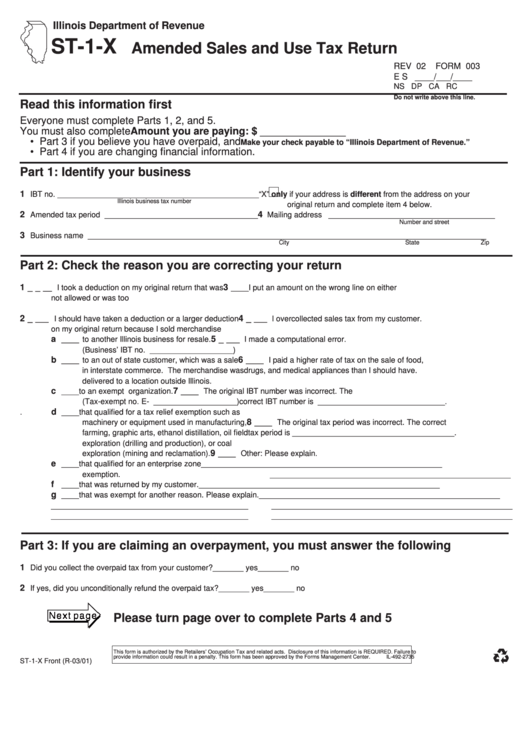

The Illinois Tax 20252025 Form Fill Out and Sign Printable PDF, You must file the form 8843. The tax filing deadline is monday, april 15, 2025.

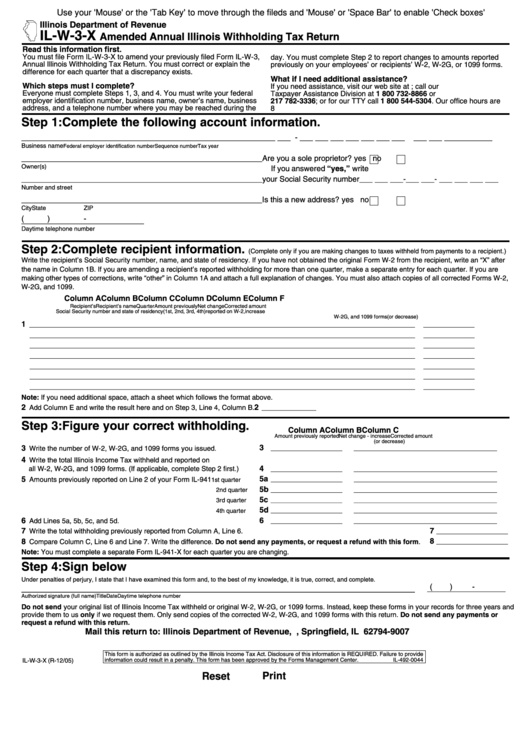

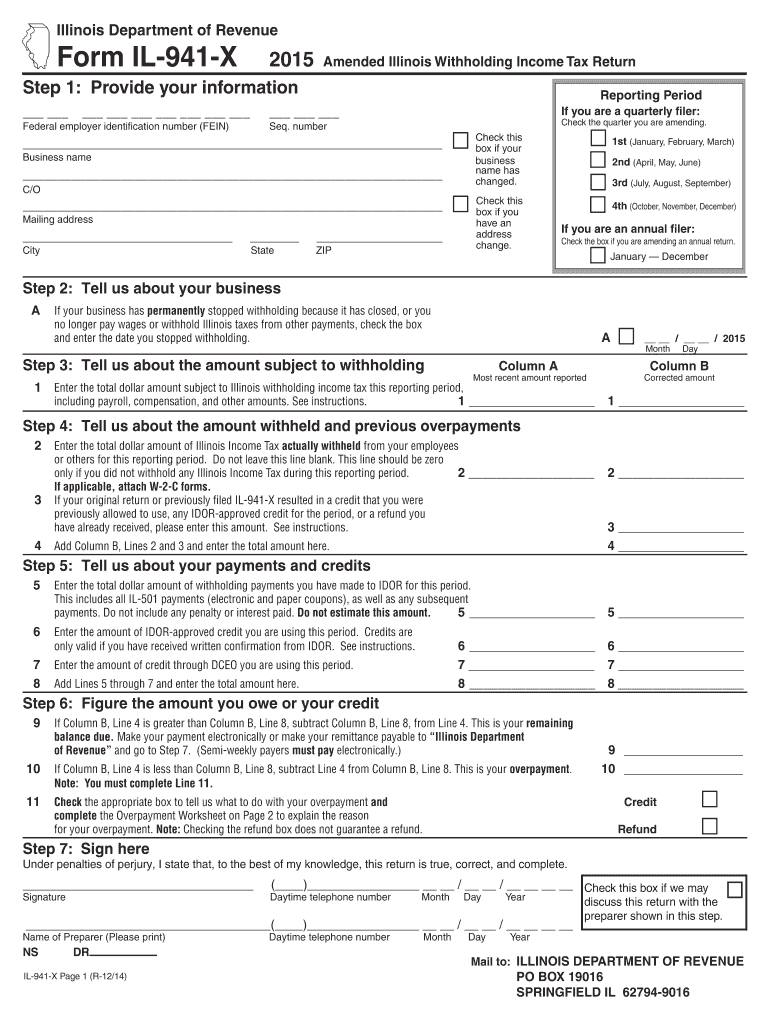

IL 941 X, Amended Illinois Withholding Tax Return Fill Out and, 2) income, base income, net income, and tax; Deadline just days away to fill out form for illinois income and property tax rebates.

Form 1040SR U.S. Tax Return for Seniors Definition and Filing, 2023 schedule icr, illinois credits; At the jo daviess county extension office at 204 vine street, elizabeth.

Revenue il Fill out & sign online DocHub, 2) income, base income, net income, and tax; For tax years 2023 and beyond (filed in 2025), the illinois eitc rises to 20%.< to find out if you qualify for benefits, check the irs' eligibility criteria.

Payment voucher for individual income tax. 2025 withholding income tax payment and return due dates.

The extended due date for filing your return is october 15, 2025.

Printable Federal 1040 Form Printable Forms Free Online, Step 5 net income and tax. The irs announced it will begin accepting and.

2025 withholding income tax payment and return due dates.

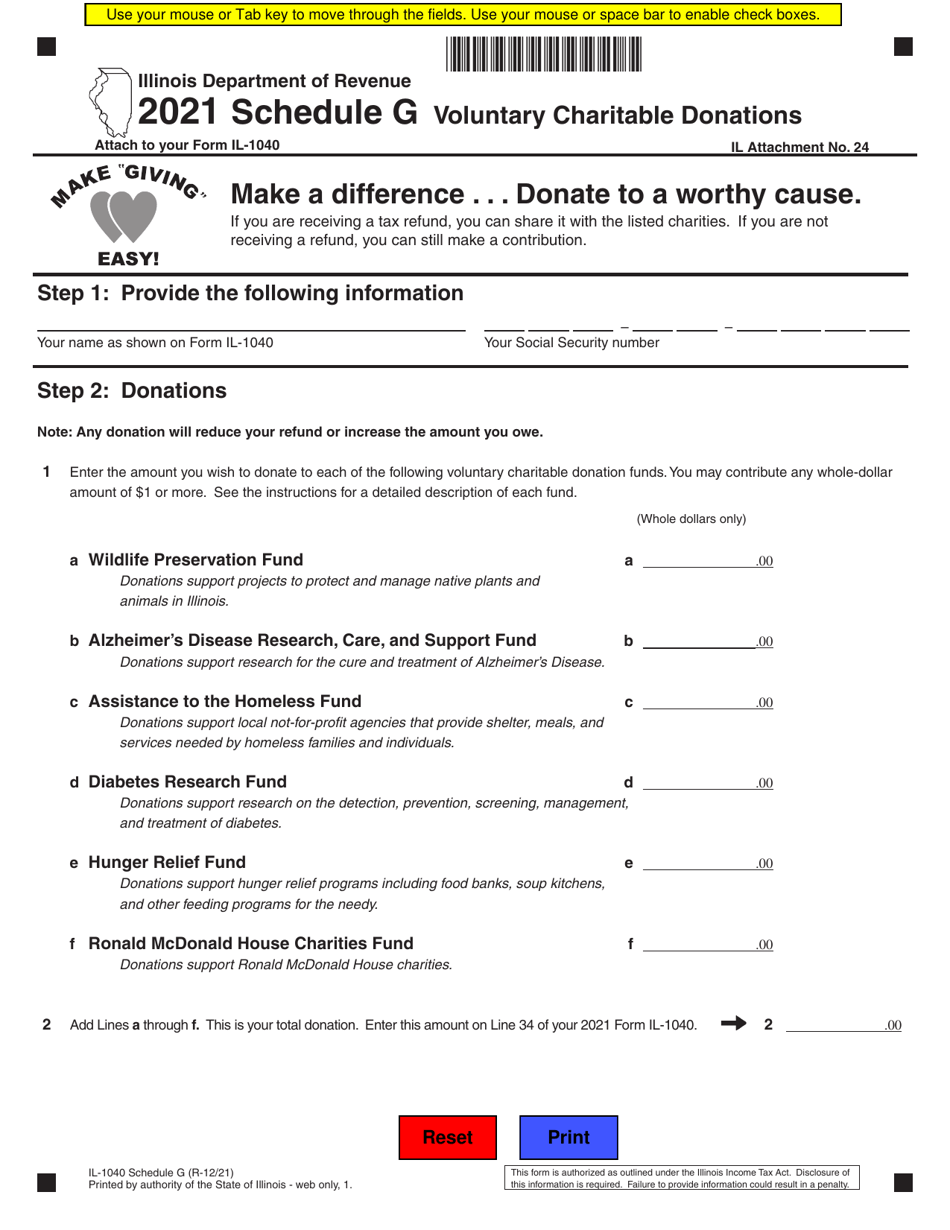

Form IL1040 Schedule G Download Fillable PDF or Fill Online Voluntary, 2) income, base income, net income, and tax; You must file the form 8843.